Diet Pills, Mega Deals, and a $7.3B Forecast Gap

Why Pfizer’s Metsera Buyout Is a Lesson in FP&A Agility

Why Pfizer’s Metsera Buyout Is a Lesson in FP&A Agility

Pfizer Inc. is closing in on a $7.3 billion acquisition of Metsera, an anti-obesity drugmaker. If finalized, it would be one of the largest pharma M&A deals in years — and Pfizer’s boldest attempt to diversify as COVID-19 vaccine revenue falls.

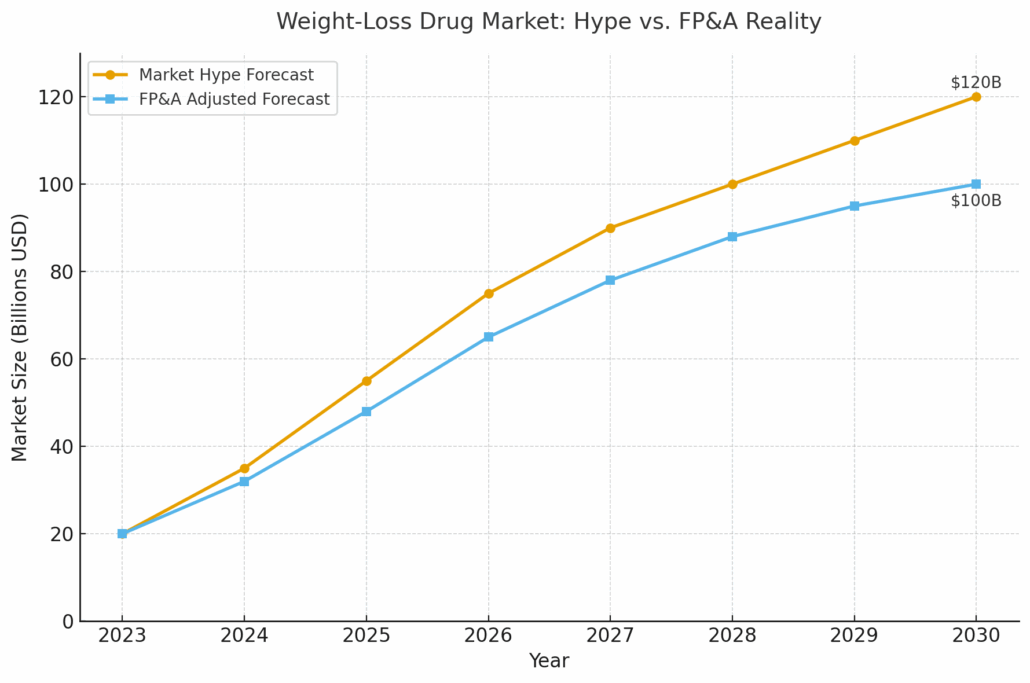

The prize? Entry into the surging weight-loss drug market, projected by analysts to hit $100 billion annually by 2030. Rivals like Novo Nordisk and Eli Lilly already dominate with Wegovy and Ozempic, leaving Pfizer under pressure to catch up.

But here’s the FP&A lesson: mega deals look simple in headlines. They’re chaos in forecasts.

Why This Matters in FP&A

A $7.3B pharma takeover isn’t just a market story. It’s a stress test for financial planning and analysis.

- Revenue Modeling Uncertainty. FP&A teams must build scenarios for drug pricing, insurance coverage, and competitive share. Today’s hype cycle could fade quickly if regulators intervene.

- Integration Cost Forecasting. The purchase price is only the entry ticket. Clinical trials, R&D pipelines, and commercial build-outs add layers of cost that must be modeled, not ignored.

- Capacity and Supply Constraints. Can Pfizer actually meet demand? FP&A must pressure-test manufacturing and distribution limits, not assume infinite scale.

- Valuation Risk Forecasts. Entering late in the GLP-1 boom means higher multiples. FP&A teams must stress-test whether projected growth justifies those premiums.

Without this, forecasts become theater — pretty decks masking fragile assumptions.

The Bigger Picture

This deal shows how the obesity drug market has gone from niche to global battlefield. Pharma giants are no longer asking if they should invest. They’re asking how late is too late.

For FP&A, that urgency translates into modeling risk faster, more often, and with brutal honesty. What if reimbursement slows? What if competitors win new indications first? What if demand outpaces production?

The Future of FP&A

At The Schlott Company, we help finance leaders sharpen their forecasting systems for exactly these moments — when ambition collides with volatility.

Our approach: scenario modeling that bakes in uncertainty, integration costs, and capacity limits. Because $7.3B bets don’t fail from ambition. They fail when FP&A forgets reality.