EV Prices Jump as $7,500 Credit Disappears

Why automakers and FP&A teams must brace for a post-incentive world.

A Subsidy Built Into the Price Tag

For 16 years, U.S. buyers of electric vehicles counted on a cushion: the $7,500 federal tax credit. It narrowed the affordability gap. It signaled government commitment. And it gave automakers cover while they scaled production and reduced costs.

On September 30, 2025, that cushion vanishes.

For consumers, it feels like an overnight price hike. For automakers, it removes a prop they’d quietly leaned on for a decade and a half. For FP&A teams, it rewrites the math—demand curves, margin models, and investment cases all need a reset.

How We Got Here

The credit wasn’t always $7,500. Its value depended on battery size and, later, on sourcing requirements. The 2022 Inflation Reduction Act tightened rules even more, imposing income caps for buyers and North American assembly mandates for automakers.

But the principle was constant: subsidize adoption until scale economics could stand on their own.

Washington now believes the industry is ready. CFOs and planners aren’t so sure.

What Happens to Prices Without It

Remove the credit, and the effective price of a new EV jumps:

- A $42,000 model that once cost $34,500 after credit is now back at $42,000.

- A $55,000 SUV that barely qualified under the cap feels suddenly overpriced next to an ICE equivalent.

- Used EVs lose the $4,000 credit that supported resale values.

Automakers have three imperfect choices: raise sticker prices, hold prices and risk lower volume, or add more incentives that crush margins.

For buyers, the calculation is blunt: many who were “in” on EVs at $35,000 are “out” at $42,000.

Global Lessons

We’ve seen this movie abroad:

- China ended subsidies in 2022. Sales dipped but recovered thanks to cheap domestic models and vast infrastructure build-out.

- Germany cut subsidies in 2023. Demand collapsed almost overnight, leaving dealerships stuck with unsold inventory.

- Norway phased out benefits gradually. Adoption slowed but held because EVs had already become the default.

The U.S. is closer to Germany than Norway. Scale isn’t universal yet, and cost parity hasn’t arrived. That means a bumpier road ahead.

The Fallout for Automakers

Expect three waves:

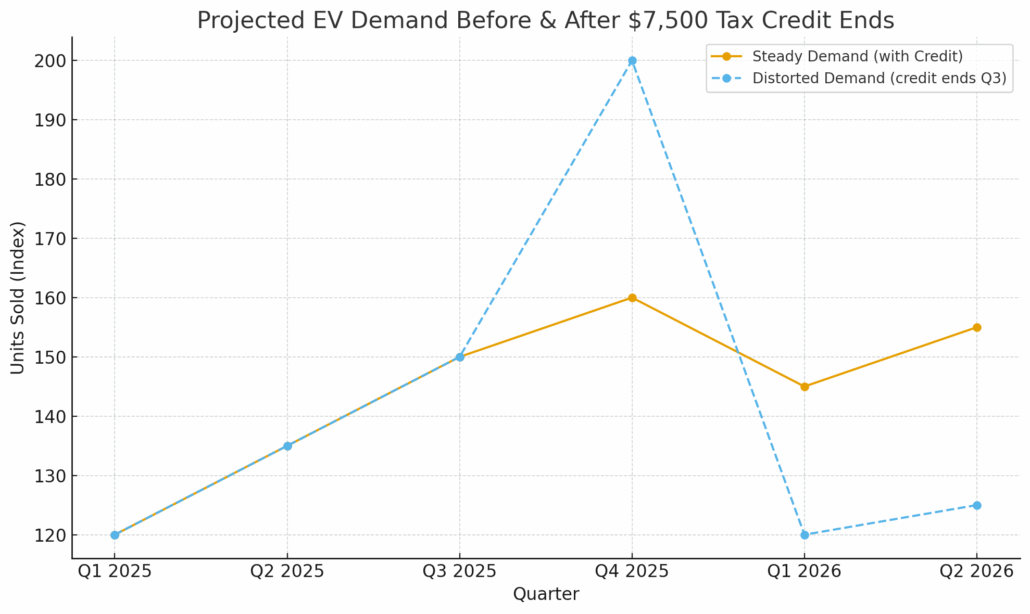

- A pre-deadline surge: Buyers rush to claim the credit before September. Automakers celebrate—but it’s artificial growth.

- A post-credit cliff: Orders dry up. Dealers push discounts. Inventory swells.

- Margin pressure: To sustain volumes, companies slash prices or layer on incentives, cutting into profits.

The companies best positioned are those with diversified portfolios. Pure-play EV makers carry more concentrated risk.

Why This Matters in FP&A

Here’s where it gets real for planners:

- Revenue Forecasting: Models built on straight-line adoption won’t hold. You need asymmetric curves—spikes before the deadline, slumps after.

- Margin Stress: Gross margins must be tested at multiple price points. A $5,000 shortfall per unit can turn profit into red ink.

- Inventory Risk: Overbuild leads to stranded stock. FP&A must model discounting scenarios in advance.

- Capex ROI: Battery plants, charging networks, R&D projects—every payback assumption changes under slower growth.

- Concentration Risk: The more a company depends on EVs, the more exposed its forecasts are to policy shocks.

Think of it like farming after subsidies end. The soil and yield are unchanged, but the economics flip overnight. That’s where automakers now stand.

What Sharp FP&A Teams Do

- Run Scenario Planning: Model three adoption paths—stable, cliff, and policy reversal.

- Stress Margins: Test gross profit across multiple incentive-free demand levels.

- Stage Capital: Break big bets into phases, preserving flexibility.

- Benchmark Globally: Learn from Germany and China rather than guessing.

- Communicate Clearly: Boards need to hear the difference between execution miss and policy shock.

The Hidden Danger

The real risk isn’t demand falling. It’s leaders assuming demand will stay flat because “consumers love EVs.”

That’s like believing a plane stays aloft without engines because it glided once. Incentives weren’t background noise—they were lift.

And when lift disappears, stalls come fast.

Final Thoughts

The end of the $7,500 EV tax credit isn’t just about higher sticker prices. It’s about distorted demand cycles, margin erosion, and investment plans built on old assumptions.

For FP&A leaders, the message is clear: incentives aren’t noise. They’re load-bearing beams. When they vanish, models built for yesterday collapse.

The smartest teams won’t just update spreadsheets. They’ll reset strategy—because the post-credit EV market is a different market entirely.