Forecast Fatigue in Finance

The Silent Exhaustion Behind Every “Updated Forecast”

It starts with good intentions.

A CFO wants more agility.

A board wants tighter visibility.

So finance does what it always does — spins up another forecast.

Before long, there’s a forecast for sales, another for spend, one for headcount, and a “rolling” version that no one quite trusts.

Every revision feels productive, until it doesn’t.

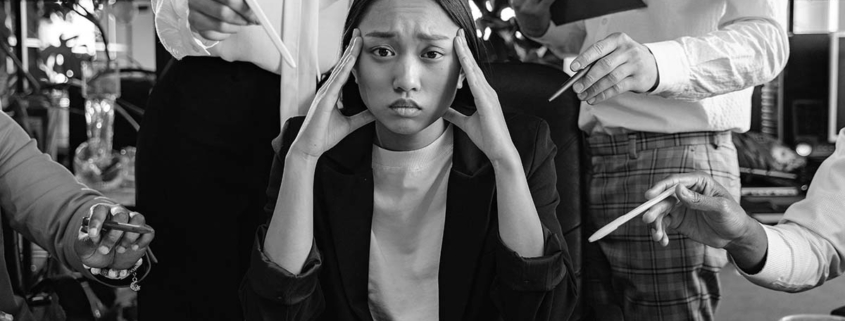

That creeping exhaustion you feel in Q3?

That’s forecast fatigue — the moment your planning cycle consumes more insight than it creates.

How Forecast Fatigue Forms

Forecast fatigue isn’t about workload. It’s about diminishing analytical return.

Every reforecast delivers less new learning than the one before it.

Yet, teams keep recalculating — because recalculating feels like control.

At The Schlott Company, we see it appear in three predictable stages:

- Overreaction.

One bad surprise triggers a push for “more frequent” forecasts. - Overbuild.

Models multiply. Each function maintains its own version “to be safe.” - Overload.

The signal disappears in the noise. Analysts maintain models instead of insights.

By the time leadership asks, “Why do we have four different EBITDA numbers?” it’s already too late.

The Cost No One Quantifies

Forecast fatigue is expensive — but not in obvious ways.

- Talent attrition. Burned-out analysts leave first.

- Decision delay. Executives wait for the next “more accurate” version.

- Model fragility. Each refresh adds more assumptions than clarity.

- Cultural erosion. Teams start valuing speed over sense.

The financial impact isn’t missed numbers; it’s missed meaning.

The Illusion of Adaptability

Reforecasting feels agile. It isn’t.

Most teams mistake frequency for responsiveness.

Updating faster doesn’t make finance more adaptive — it makes it perpetually mid-update.

The business changes again before the new forecast is socialized.

Everyone ends up working inside yesterday’s model labeled as tomorrow’s truth.

It’s the same loop we described in forecasting: speed without structure just compounds latency.

The Forecast Efficiency Curve™

To break the cycle, we built the Forecast Efficiency Curve™ — a Schlott Company diagnostic that measures how much value each new forecast iteration adds.

Plot effort on the X-axis and incremental insight on the Y-axis.

At first, returns rise sharply.

Each reforecast uncovers new signals.

Then the curve flattens — the fatigue zone.

Beyond that, extra work actually reduces clarity.

Our data across clients shows the turning point almost always arrives around the third major reforecast in a fiscal year.

After that, you’re polishing noise.

Three Design Levers That Restore Efficiency

1. Shorten Interpretation Loops

The insight isn’t in the forecast — it’s in the conversation after the forecast.

Limit cycles; lengthen discussions.

2. Automate Recalculation, Not Reflection

Automate mechanical updates (currency, payroll, revenue pulls), but keep scenario logic human.

Automation should buy thinking time, not remove it.

3. Codify “Good Enough” Thresholds

Set quantitative stop points: if forecast variance < X %, freeze the update.

Clarity loves constraint.

These levers transform forecasting from endurance sport to strategic rhythm.

When Activity Replaces Intelligence

In fatigued finance teams, meetings sound busy but feel hollow.

“Did we update marketing’s spend yet?”

“Is sales still on version 8 or 9?”

What’s missing is synthesis — the connective tissue between numbers and narrative.

Teams lose the habit of explaining change; they just keep measuring it.

That’s when the function starts burning out its own insight.

Rethinking Cadence: The Pulse, Not the Metronome

Healthy forecasting runs like a pulse — steady, responsive, but never frantic.

Unhealthy forecasting ticks like a metronome — constant motion, zero adaptation.

At The Schlott Company, we teach clients to anchor forecasting around business triggers, not calendar dates.

When pipeline moves ± 10 %, when churn shifts ± 2 %, when hiring plans cross threshold X — then reforecast.

Otherwise, hold.

That small discipline restores the signal-to-noise ratio of decision-making.

Leadership’s Role in Breaking the Loop

Forecast fatigue is often sponsored from the top.

Boards and CEOs ask for “fresh numbers” before decisions — not realizing that freshness isn’t the same as relevance.

The best CFOs push back. They say:

“You don’t need a new forecast. You need a new lens on the one we already have.”

Leadership must model restraint.

If finance keeps updating every time someone asks “what’s new,” the answer will always be “nothing meaningful.”

How AI Is Quietly Amplifying Fatigue

Ironically, automation can worsen forecast fatigue.

AI makes updating effortless — which means updates happen constantly.

Without guardrails, you end up with a 24/7 forecast treadmill that never rests long enough to learn.

As we wrote in precision, technology magnifies whatever process already exists.

If your forecasting cycle is undisciplined, AI just accelerates the chaos.

The solution isn’t more automation — it’s smarter cadence design.

Measuring Recovery

To track improvement, measure three metrics:

- Forecast Cycle Time — days spent from trigger to approval.

- Forecast Reuse Rate — how often the same forecast informs multiple decisions.

- Analyst Engagement Score — qualitative pulse on mental load.

When these stabilize, your team has exited fatigue and re-entered insight.

The Schlott Company Lens

At The Schlott Company, we rebuild FP&A systems that value signal longevity over forecast frequency.

Our clients learn that agility isn’t about more versions — it’s about fewer, smarter resets anchored to business reality.

In one engagement, a client cut reforecasts from nine a year to four — and doubled decision speed.

Less effort. More foresight.

That’s the Forecast Efficiency Curve in action.

Closing Thought

Forecast fatigue isn’t a software problem.

It’s a discipline problem disguised as diligence.

The cure isn’t to forecast faster.

It’s to forecast just enough — and think longer.

Because the goal of FP&A was never to predict perfectly.

It was to prepare intelligently.