JLR Cyberattack: Production Halt to Oct 1 — Big FP&A Risks Ahead

Jaguar Land Rover cyberattack halts production

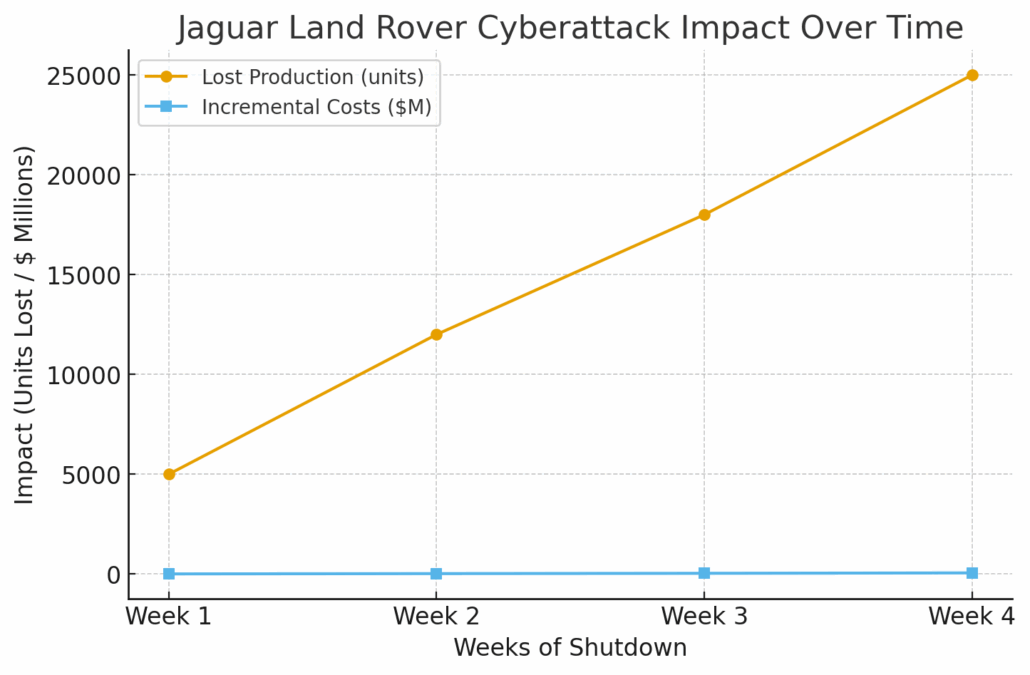

Jaguar Land Rover has extended its production shutdown until at least October 1, 2025, following a crippling cyberattack that disrupted core operations across its U.K. factories.

What began as a short pause has stretched into weeks of halted assembly lines, idle workers, and suppliers under stress. The company is still working to restore systems and build a timeline for a phased restart.

For most headlines, this is just another corporate crisis. But for FP&A teams in manufacturing, automotive, and beyond, the lessons are urgent. A production pause of this scale isn’t just operational. It rewrites the entire financial plan.

Why this shutdown matters for FP&A

FP&A sits at the intersection of revenue forecasts, cost control, and liquidity. A disruption like the Jaguar Land Rover cyberattack reverberates across every model.

1. Reforecasting under uncertainty

Revenue tied to vehicle deliveries evaporates when lines are down. FP&A must now rebuild scenarios — best case if plants restart by Oct. 1, worst case if delays stretch further.

2. Cash flow stress testing

Fixed costs like payroll and facilities don’t stop. FP&A must analyze how long liquidity can sustain operations, prioritize supplier payments, and evaluate whether credit lines or insurance coverage can bridge the gap.

3. Supply chain disruption analysis

JLR’s suppliers face their own strain. Many are SMEs reliant on steady orders. FP&A needs to model cascading impacts — will suppliers survive the pause, or will shortages ripple into the restart phase?

4. Incremental cost tracking

Cybersecurity response, legal fees, idle labor, and potential penalties all land on the P&L. FP&A must track these costs precisely to inform both short-term reporting and longer-term risk investment decisions.

5. Strategic reprioritization

This isn’t just about plugging short-term leaks. The cyberattack forces a rethink:

- Should more budget shift toward resilience, redundancy, or cyber defense?

- How do you weigh those investments against EV transition or new product launches?

Lessons FP&A can draw

Think of this like an engine under stress. One small part fails, and suddenly the whole system stalls. Without resilience built in, recovery becomes longer, costlier, and riskier.

For FP&A, the Jaguar Land Rover production pause is a stark reminder that:

- Resilience is a financial strategy, not just an IT one.

- Just-in-time efficiency has hidden fragility that must be stress-tested.

- Scenario planning isn’t optional — it’s the difference between proactive steering and reactive scrambling.

Why it’s more than a JLR story

If you lead FP&A in automotive or any sector with complex supply chains, this event should serve as a live case study. Cyber risk isn’t abstract anymore — it directly threatens production, revenue, and liquidity.

The Jaguar Land Rover cyberattack may resolve in weeks. But the scars will last far longer. Investors, regulators, and boards will demand new levels of transparency and risk control. And FP&A will be the team responsible for showing how resilient — or fragile — the business truly is.

Final Thoughts

The production halt at Jaguar Land Rover is more than a corporate disruption. It’s a test case in how quickly FP&A can pivot under crisis. Reforecast fast. Track cash relentlessly. Stress test scenarios. Because when operations stall, finance is the last engine still running.