Forecast Models Age Like Milk, Not Like Wine

Why FP&A Must Build Decay Into Assumptions

Most FP&A teams treat their models as immortal. Build it once, lock it down, circulate the deck. A month later, six months later, a year later — the same model is still being referenced, as if assumptions never rot.

But here’s the thing: assumptions decay. Quickly. Faster than most finance leaders admit. And when you don’t account for that decay, your model doesn’t age gracefully — it curdles.

The Blind Spot

Here’s how models silently spoil:

- You assume customer churn stays at 5%, but competitors launch features you don’t have.

- You model CAC based on last year’s paid channels, ignoring market saturation.

- You build revenue growth on hiring plans, while talent markets tighten overnight.

The assumptions look fine on paper. But like milk in the fridge, they’re already turning.

The Fallout

Assumption rot leads to two dangerous outcomes:

- False precision. Leaders believe forecasts are stable because the numbers haven’t changed, even though reality has.

- Compounding error. Small misses stack into big misses, until the whole plan collapses under scrutiny.

And the worst part? Nobody notices until the model starts to smell.

The Decay-Aware Forecasting Framework

At The Schlott Company, we help CFOs stop pretending assumptions are permanent and start building decay directly into FP&A.

The framework:

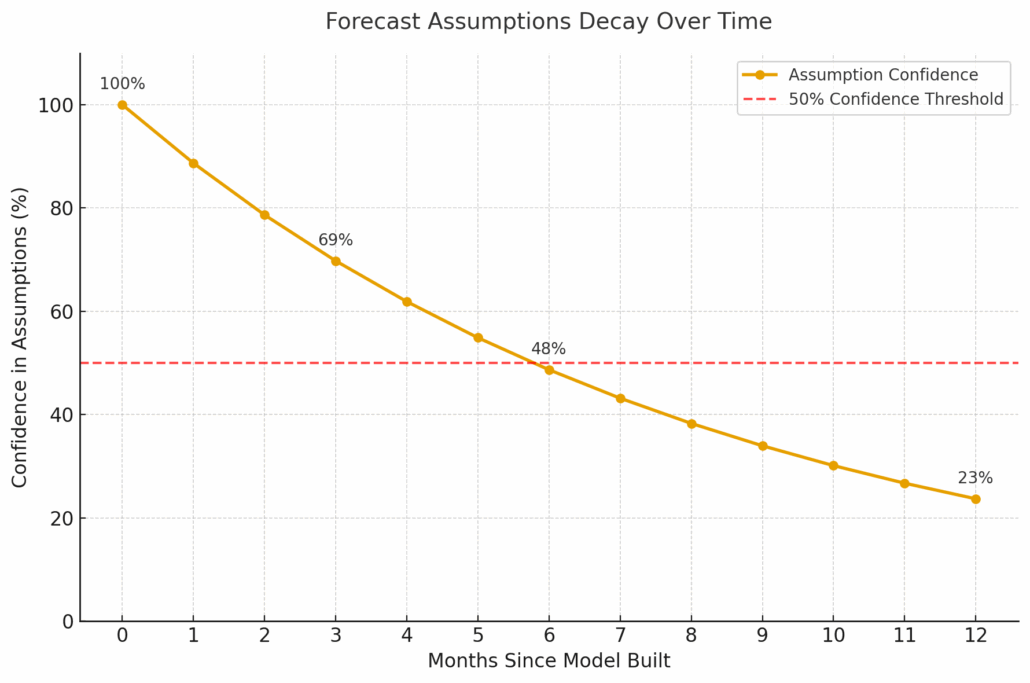

- Half-Life Mapping — Assign a “shelf life” to assumptions. Some last a year. Some expire in weeks.

- Decay Factors — Reduce confidence in inputs as they age, forcing regular recalibration.

- Signal Monitoring — Track market and internal data to refresh expiring assumptions.

- Decision Checkpoints — Build re-forecast triggers tied to assumption half-lives, not just calendar dates.

This doesn’t make forecasts perfect. It makes them honest.

Why It Matters

The world doesn’t move in static tables. It moves in decaying probabilities. Models that don’t capture that drift are fiction.

When FP&A leaders build decay into their assumptions, they stop defending ghosts and start shaping decisions with credibility. Boards notice. Investors notice. Teams notice.

The Future of FP&A

The next frontier isn’t prettier dashboards. It’s models that admit the clock is always ticking.

At The Schlott Company, we design decision-systems that embed assumption decay into the heart of FP&A — giving CFOs forecasts that stay alive longer, adapt faster, and lose the smell of stale spreadsheets.

Because forecast models don’t age like wine. They age like milk. And if you don’t check the date, you’ll end up drinking something sour.